Hsmb Advisory Llc Things To Know Before You Buy

Not known Facts About Hsmb Advisory Llc

Table of ContentsThe 3-Minute Rule for Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Mean?The 6-Second Trick For Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You BuySome Known Details About Hsmb Advisory Llc

A variant, called indexed global life insurance policy, gives an insurance policy holder the choice to divide cash worth amounts to a fixed account (low-risk investments that will certainly not be impacted by the stock market) or an equity indexed account, such as Nasdaq 100 or the S & P 500. https://www.edocr.com/v/rn0xbvw2/hunterblack33701/hsmb-advisory-llc. The policyholder has the selection of just how much to allot to each accountThese plans are called joint or survivorship life insurance policy and can be either first-to-die or second-to-die plans. A first-to-die joint life insurance policy implies that the life insurance coverage is paid after the initial person passes away - St Petersburg, FL Health Insurance. As an example, John and Mary get a joint first-to-die policy. John dies before Mary does, so the plan pays to Mary and/or other recipients.

These are normally used in estate preparation so there suffices money to pay inheritance tax and various other costs after the fatality of both spouses. As an example, let's claim John and Mary took out a joint second-to-die plan. So among them is dead, the policy is still active and does not pay.

The Basic Principles Of Hsmb Advisory Llc

This ensures your loan provider is paid the balance of your mortgage if you pass away. Dependent life insurance policy is coverage that is provided if a spouse or dependent youngster passes away. This kind of coverage is normally utilized to off-set costs that take place after fatality, so the amount is usually tiny.

What Does Hsmb Advisory Llc Mean?

This type of insurance coverage is additionally called burial insurance policy. While it might appear odd to get life insurance coverage for this kind of activity, funeralseven simple onescan have a price tag of numerous thousand dollars by the time all prices are factored in. That's a great deal to discover. Finding out that you need life insurance policy is the initial step.

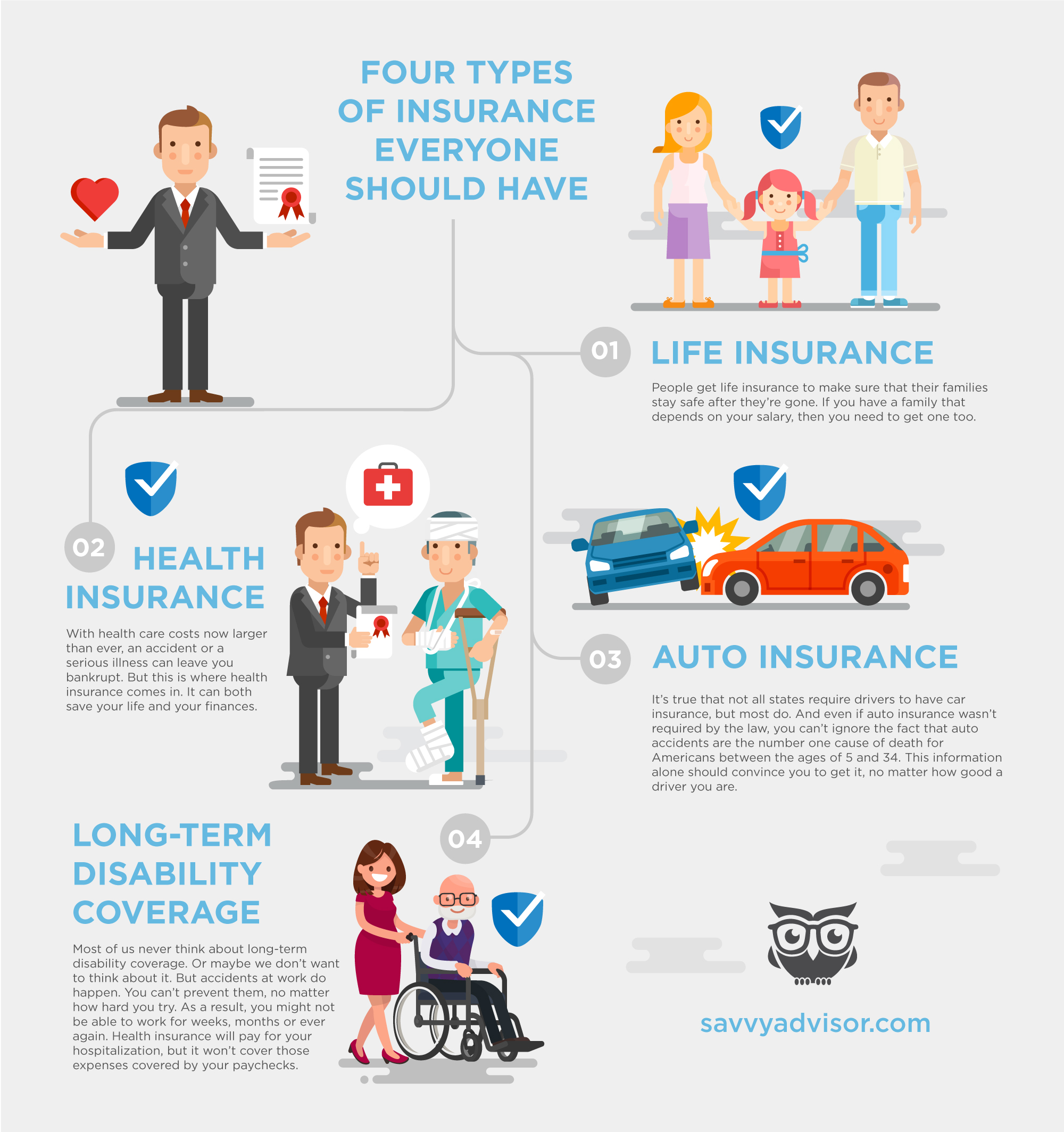

We're right here to assist you break through the clutter and discover more concerning one of the most prominent kinds of life insurance, so you can choose what's best for you.

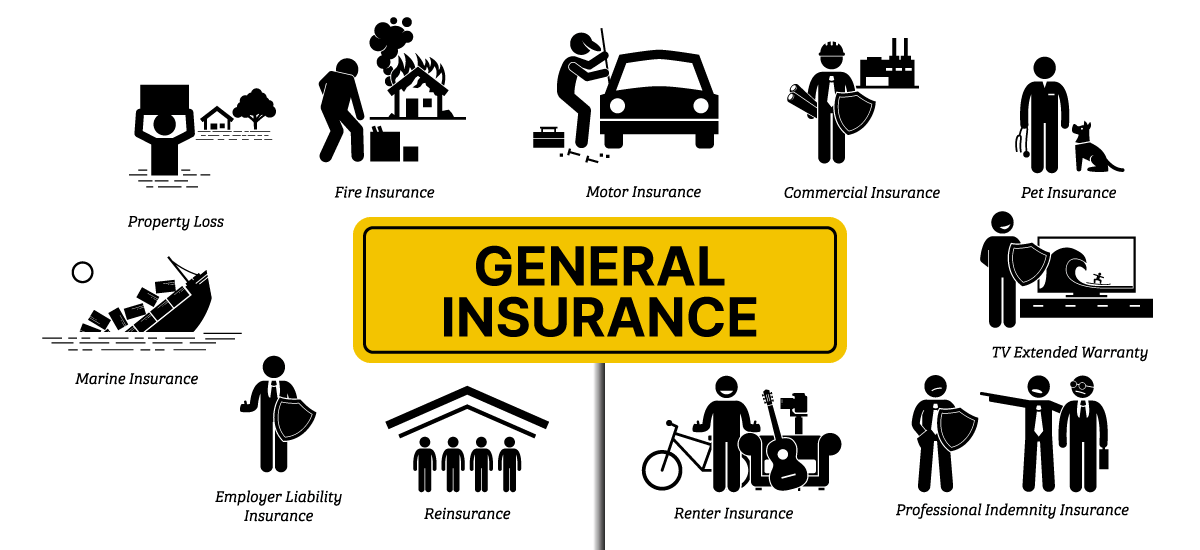

This page provides a reference of insurance coverage terms and interpretations that are frequently made use of in the insurance policy organization. New terms will be added to the glossary in time. The interpretations in this glossary are established by the NAIC Study and Actuarial Department team based upon different insurance policy references. These interpretations represent a common or general use of the term.

The 45-Second Trick For Hsmb Advisory Llc

- unforeseen injury to a person. - an insurance policy agreement that pays a stated benefit in the event of death and/or dismemberment created by mishap or defined kinds of accidents. - period of time insured must incur eligible medical costs at least equal to the deductible quantity in order to establish an advantage duration under a significant clinical expenditure or detailed clinical expenditure plan.

- insurance firm properties which can be valued and included on the balance sheet to identify economic viability of the company. - an insurance policy company certified to do company in a state(s), domiciled in an alternative state or nation. - happen when a policy has been refined, and the premium has actually been paid before the reliable date.

- the social phenomenon whereby persons with a higher than typical possibility of loss look for greater insurance policy protection than those with less danger. - a team supported by member firms whose feature is to collect loss stats and release trended loss prices. - an individual or entity that straight, or indirectly, through several other individuals or entities, controls, is regulated by or is under common control with the insurance firm.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

- the optimal buck quantity or complete amount of insurance coverage payable for a solitary loss, or numerous losses, throughout a plan duration, or on a solitary job. - method of compensation of a health strategy with a corporate entity that directly supplies care, where (1) the health insurance plan is contractually required to pay the complete operating expenses of the business entity, less any type of income to the entity from other individuals of solutions, and (2) there are shared limitless warranties of solvency in between the entity and the health insurance plan that put their particular capital and excess at risk in guaranteeing each various other.

- an insurance business developed according to the laws of an international country. The company needs to adapt to state governing requirements to legitimately market insurance coverage products in that state. - insurance coverages which are usually written with home insurance policy, e.- an annual report required to be filed with each state in which an insurer does business.